Ever since the Federal Reserve began the process of hiking rates to fight historic levels of inflation, economists and pundits have been forecasting a recession – with the only debate as the whether it will be hard landing or soft. More than a year into the rate hike cycle, stocks are in a bear market, the yield curve is solidly inverted, and the single family housing market is in a deep freeze. And yet, inflation remains stubbornly high, job growth, spending and manufacturing all have remained strong. We are increasingly looking at the “no landing” scenario, where continued economic strength forced the Fed to raise rates above 5% and keep them there for a much longer period of time than anyone has previously imagined.

The consequences of the “higher/longer” scenario for the economy as a whole are unclear: will it mean a milder, prolonged no/low growth cycle, or will knock-on effects lead to a sharper downturn? No one knows for sure, including the Fed itself. However, one asset class stands to benefit more than others in such a scenario: multifamily real estate.

There are many reasons for this, some cyclical and some structural. One primary cyclical reason is that the alternative to renting, owning a home, became significantly more expensive in the last 12 months due to mortgage rates more than doubling. Also the housing boom that just ended has lifted home prices beyond the reach of most Americans. A recent report from Harvard’s JCHS stated that in one year, 4 million potential homebuyers got priced out of the market.

That is a major boost to marginal demand for rental apartments. Furthermore, elevated home prices are unlikely to fall rapidly as many current homeowners have locked in extremely low mortgage rates and are unlikely to need to sell. And higher rates for a new purchase mean they are less likely to sell their current home when a new one will cost so much more to finance.

The relatively high number of new units coming online over the next two years may negatively impact specific markets like Austin, where the new units are a high percentage of the total supply. But overall the increased supply of new apartments is much smaller than the marginal demand for renting instead of buying.

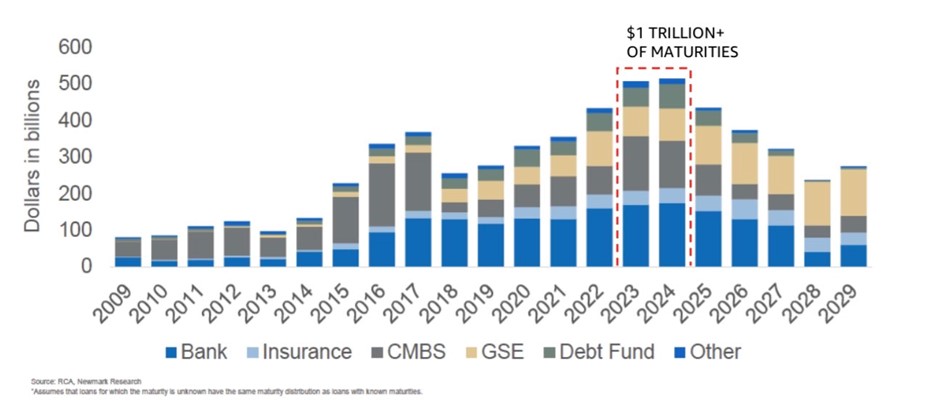

The “higher/longer” rates scenario is ideal for would-be buyers of multifamily assets because as rates stay high for longer, cap rates for quality assets will inevitably rise. This process has already started, but right now there is a standoff between buyers and sellers. Once the Fed shows its resolve to keep rates high indefinitely, sellers will be more likely to capitulate. Increasing the likelihood of financially distressed assets changing hands is a looming wall of debt maturities for commercial real estate loans.

As we can see from this chart by Newmark, $1 trillion worth of commercial real estate debt will mature over the next two years. Many assets that are highly levered may not be able to refinance, providing once in a decade buying opportunities.

The US economy, when compared to those of Europe and Asia, remains the most resilient and best positioned to thrive under an inflationary environment. This is why multifamily real estate remains the top choice of investors for its stability, risk protection, inflation-hedging, and tax efficiency.

Stability & Cash Flow

One of the main draws of multifamily real estate is its stability. As opposed to single-family homes, multifamily properties tend to be less affected by market fluctuations. This makes them ideal investments as you can more reliably predict your cash flow over time. Additionally, apartment buildings tend to be located in urban areas with high population density which means there is usually a steady demand for rental units – regardless of the economic climate.

Risk Protection & Inflation-Hedging

When investing in real estate, risk management should always be top-of-mind. Not only do multifamily properties offer numerous layers of safety precautions against market downturns but they also provide an opportunity to hedge against inflationary pressures. As prices increase due to inflationary forces, your income from rent payments will also increase accordingly – resulting in higher returns on investment over time. Additionally, these investments offer some tax advantages such as depreciation deductions which can help offset capital gains taxes and other liabilities associated with owning property.

Tax Efficiency

Multifamily real estate offers a unique tax advantage over other investments as it allows owners to write off depreciation expenses associated with each unit or building through their tax filings each year. This not only helps you save money on taxes but it also gives you more financial flexibility when it comes to operating costs associated with owning and managing a property portfolio. Plus, given that income generated from rental units is considered passive income, owners may be eligible for additional deductions and credits depending on their individual situation – making this asset class even more attractive from a tax standpoint!

Multifamily real estate remains one of the most attractive asset classes for investors today due to its stability, risk protection, inflation-hedging capabilities, and tax efficiency benefits. With economists forecasting a “no landing” scenario for interest rates over the coming years, now may be the perfect time for investors to consider adding multifamily properties into their portfolios as attractive cap rates become increasingly available in the market place. At LTL Investments we are dedicated to helping our clients make informed decisions about their investments so if you have any questions or would like more information about our services please do not hesitate to contact us today!”